Markets tumble as Bitcoin ETFs face first outflow in 19 days

Markets took a dive amid the first exits of positions from the big-four Bitcoin ETF funds. Bitcoin briefly hit the $70k mark yesterday before diving this morning to $67,344.

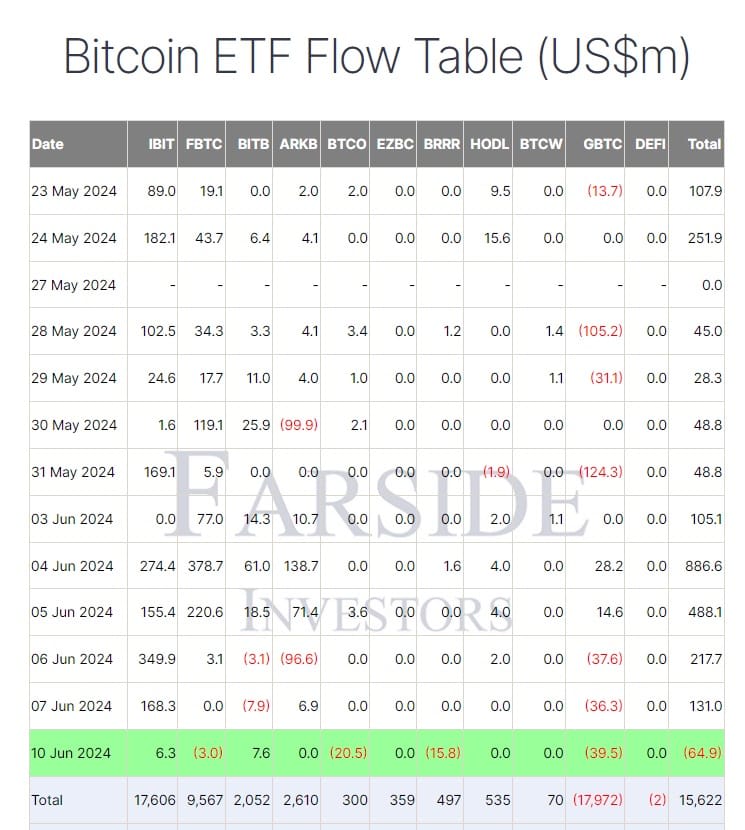

On 10th June, Bitcoin (BTC) exchange-traded funds (ETFs) had a bit of a hiccup with a $64.9 million outflow, breaking a solid streak of 19 straight trading days of inflows. This was the first outflow since 10th May, and it was mainly due to four big ETF issuers.

Grayscale’s GBTC took the biggest hit, with $39.5 million flowing out, bringing their total outflows to a staggering $18 billion. The BTCO Invesco Galaxy ETF also saw a hefty $20.5 million outflow, but they’re still in the positive with a total net inflow of $300 million. Valkyrie’s BRRR ETF had a $15.8 million outflow but still stands strong with a total net inflow of $497 million. Fidelity’s FBTC faced a smaller outflow of $3 million but continues to shine with a robust total inflow of $9.6 billion, according to Farside data.

However, not everyone had a tough day. BlackRock’s IBIT recorded a nice inflow of $6.3 million, and Bitwise’s BITB ETF saw an inflow of $7.6 million. So, despite the recent outflows, Bitcoin ETFs still have a substantial total inflow of $15.6 billion, which is quite impressive.